How to help patients finance eye surgery

Laser and cataract surgery isn’t cheap. Expecting someone to make a lump-sum payment for a procedure that exceeds their average monthly cost of living is unrealistic for a significant per cent of your potential market.

With rising unemployment rates1https://www.bbc.co.uk/news/business-52660591, higher-income uncertainty2https://www.marketingcharts.com/customer-centric/spending-trends-114244 and the average cost of living continuing to climb3https://www.evolutionmoney.co.uk/news/cost-living-increasing-faster-real-wages, it’s no surprise that consumers have been feeling more concerned about money. Even before COVID-19, practices around the world could expect to increase the number of people that chose to proceed with surgery when they gave their patients a choice to finance their procedures.

In this post, we break down how patients pay for private eye surgery and how to successfully use financing options.

Financing is now the preferred payment option

It’s no longer an optional extra, but a cost of doing business. You must give your patients every reason to choose you over other providers. A payment plan will help you remain competitive in a marketplace now dominated by instalment payment schemes.

Studies 4Duologi. 2021. The Value Of Offering Payment Plans For UK Customers | Duologi. [online] Available at: <https://duologi.com/ideas/offering-payment-plans-for-uk-customers/>show that ⅓ of UK customers are more likely to spend with a retailer that offers finance options. In the US, the vast majority of refractive surgeons (±95%) offer financing to their patients; however, not all patients select it.

The table below shows what percentage of US patients opt to finance their procedures:

| Percentage Range of Patients Financed | Percentage of Surgeons Reporting this Range |

|---|---|

| Financing not offered | 5.1% |

| Less than 5% of patients select financing | 12.8% |

| 5% to 14% select financing | 12.8% |

| 15% to 24% select financing | 14.1% |

| 25% to 49% select financing | 30.8% |

| 50% or more select financing | 24.4% |

Source: Market Scope Survey of US Refractive Surgeons, July 2014

Instalments make your price appear lower

Giving people the option to pay for eye surgery in smaller increments (rather than one lump sum) anchors them on a smaller price.

Let us explain – Suppose you’re selling eye surgery for £4995. By offering payment instalments (e.g. 36 payments of 138.75), you alter people’s comparison process. They’ll be more likely to compare your instalment price (£138.75) to a competitor’s lump sum (e.g., £5000) – a huge difference that makes your offering more appealing.

Of course, people aren’t simple. They know that comparing £138.75 and £5000 isn’t accurate.

Surprisingly, that doesn’t matter. People often compare prices subconsciously. So your instalment price has a good chance of altering that comparison5https://journals.sagepub.com/doi/10.1509/jmkg.2005.69.4.84.

Offer financing schemes in your ads

“Laser eye surgery cost” is among the most popular searches related to laser eye surgery on Google. Therefore, it pays to offer targeted ads that serve this user intent. For example, these results from the search query “financing laser eye surgery” Note how these ads have ad copy that sells instalment plans.

If you were to follow these ads, you’d also note that they offer landing pages targeted at serving the user’s intent (i.e. to do with financing).

Offer financing on your website

First off, you should mention that you offer financing on your website. Start by adding the word “financing” or “payment plans” to your menu. For example, LASIK MD in Canada and the US do a good job with this menu – clearly showing they offer financing right next to the call to action button:

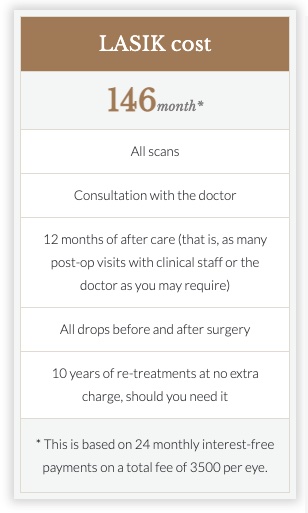

When talking about financing on the page, they use this graphic and text copy to sell the benefits of financing your treatment.

When displaying your prices on your costs page, you should break them down into instalments. Here’s an example of how a practice in Aukland, New Zealand, offer their price accompanied by their financing price point:

We often go one step further and just do that math for the visitor while showing the full price as a footnote – as we do here with our client VSON:

Mention financing on the first phone call – if the caller asks about cost

This is a particularly nuanced piece of advice. If your first contact people are involved on a phone or video call with a prospect, I advise you to not offer financing as a means of cajoling a patient to come in for an appointment – unless they cite cost as an objection.

Again, handling first contact phone calls requires training which is beyond the scope of this blog post. But what I can tell you is that you should focus the call more on emotional wants as opposed to logical needs.

Financing is a logical discussion. All things being equal, most people would prefer to financing their procedures than pay in one lump sum. However, that alone isn’t a sufficient reason to come in and see if you’re suitable for laser eye surgery.

I find that most people on the industry side put much too much importance on the cost objection. In reality, it’s not present for everyone – and most people who call have already seen the cost on the website, so why bring it up at all? But, of course, if you’re trying to screen out tyre-kickers for free appointments, that’s another story.

Use financing as a means of preparing quotes and closing at first appointments

In my “Ready to Close” course, I advise participants to use a money worksheet (or patient application form) that includes:

- Name

- Recommendation

- Recommended date and time

- Person performing procedure

- Initial investment

- Balance investment

- Number of months (if financed)

- Interest rate (if applicable)

- Total investment

I don’t recommend anyone to ask for full payments at first appointments. Instead, teach counsellors to point at the initial investment and ask:

“Do you want to put this on your credit or debit card?”

When the patient says either, I tell them to “hold your hand out and process the payment. But, first, congratulate the patient and then formalise all of the other necessary arrangements.”

That’s it. But understand that this works best when I ask for a deposit – which I usually recommend being the first month of a monthly instalment, or up to 10% of surgery fees if the patient wants to keep monthly costs lower.

I also recommend having two types of financing available – interest-free and interest-bearing.

I recommend offering interest-free when patients express they don’t want to pay interest or anything more than the procedure’s cost.

I recommend offering interest-bearing when patients express they need to keep monthly payments as low as possible.

Financing, you see, is a tool to close. Therefore, you must wield it appropriately to help nudge a small percentage of people over the fence.

Who offers financing facilities for eye surgery practices?

The specifics of how customer finance and payment plans work for your practice will depend on the type of package(s) you choose to offer. There are many different models available. Each will appeal to a different type of patient. Popular choices include “buy now, pay later”, “0% interest-free finance”, “interest-bearing plans”, “zero deposit payment plans”, and many more.

Because laser and refractive cataract surgeons are behind the curve when offering financing, here are three finance companies that could be attractive to your patients.

| Hitachi Capital | Finance4Patients | Care Credit (US) | |

|---|---|---|---|

| How much do you lend? | £2,500 – £25,000 | £250 – £15,000 | $500 – no maximum (just depends on credit score) |

| How long will I have to pay it back? | Between 24-60 months | 6, 10 and 12 months | 6, 12, 18, 24, 36, 48, or 60 months |

| How much will I pay in interest? | £2,500-£2,999 – 13.4% APR £3,000-£4,999 – 8.4% APR £5,000-£25,000 – 3.5% APR” |

Interest-free | Standard APR 26.99% No interest if paid in full within 6, 12, 18, 24. Reduced APR special financing options of 24, 36, 48, 60.Purchases of $1,000 or more may be eligible for a 24months offer with a 14.90% APR, a 36 months offer with a 15.90% APR or a 48 months offer with a 16.90% APR.Purchases of $2,500 or more may be eligible for a 60 months offer with a 17.90% APR. |

| How soon can I get the funds? | Within 48 hours | Decision is imminent | 1-2 business days |

| Is my credit score affected? | It is affected every time you decline but only “soft search” so isn’t affected forever, just for a couple of weeks | It is affected every time you decline but only “soft search” so isn’t affected forever, just for a couple of weeks | Hard enquiry but soft search |

| Are there any fees? | Competitive personal loan rates from just 2.8% APR | No set up costs. 6 months = 7.25%, 10 months = 8.35%, 12 months = 8.75% | Depends on speciality of provider and buying groups |

| How does the clinic set up with the lender? | Online form | 2 week set-up. Online and zoom call | Call Care Credit and fill out application (3-7 business days) |

| How does the patient apply? | Simple application process | Simple application process | Online/ Application form by mail or phone- most people do online or through phone (instant approval). 2 weeks to find out if done by mail |

| Other advantages? | Fast online application, instant decision. A loan processed every 60 seconds. | 3 lenders- if you decline with 1 bank, they use another. Associated with Klarna- for brand recognition. | All done through Syncrity bank. All info is run through transunion, experian and equifax. |

Why subscribe?

If you like our content but feel too busy to remember to keep coming back to our blog just in case we’ve published a new post, subscribe and you too will receive weekly notifications linked to relevant and timely advice about how to build the practice and life you’ll love. We’ll also throw in some subscriber-exclusive content that will enable you to stay ahead of the competition. We’ll keep your email address private and you can unsubscribe at any time.

Subscribe and get:

- Powerful tips in succinct and timely articles

- Insightful interviews that educate and inform

- Useful videos that show you how to grow your practice

- Invites to interactive webinars that teach real-world techniques

- Case studies that show you how we reliably grow your colleague’s practices

Do you use Facebook?

Like and follow our Facebook Page HERE to grow your private healthcare clinic with hundreds of other healthcare marketers.

If you enjoyed this post, you can also get updates from us. We’ll send email updates about new posts, and tips and tricks to build the practice and life you love. Just sign-up as a blog subscriber and you’re good!

Can I make a tiny request?

I know most people don’t share blog posts because they feel that us bloggers don’t need their “tiny” social share. But here’s the truth…

We built this blog piece by piece, one small share at a time, and we will continue to do so. So, thank you so much for your support, dear reader.

A share from you would seriously help a lot with the growth of this blog. It won’t take more than 10 seconds of your time. The share buttons are right here. 🙂