Strategies to roar out of a recession for private healthcare companies

The Telegraph reported this week that Britain would not fall into a recession following the EU referendum, citing a Moody’s report. However, the report said, “growth will slow down”. On the other hand, YouGov reported that Consumer Confidence is at its lowest ebb in three years, which is highly correlated with a recession for private healthcare.

“Our latest figures with Cebr show that July’s Consumer Confidence Index stands at 106.6 – its lowest level since July 2013 when it was 105.8. The Index has fallen by 4.7 points in the last month, which represents the joint highest month-on-month decrease since the summer of 2010.”

As I mentioned in my previous post, Consumer confidence has a robust and reliable positive association with elective surgery uptake. The higher consumer confidence rises, the more people opt for expensive and discretionary elective surgical procedures. The inverse is also true.

Whether a recession for private healthcare happens or not, consumers are wary and elective surgery providers will need to respond.

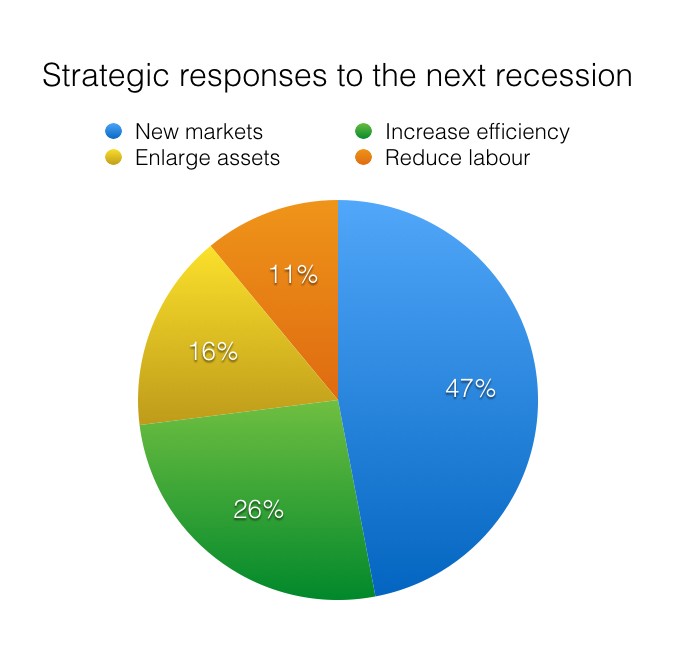

In my previous post, I also asked how you might respond to a recession for private healthcare companies. Would you:

- Develop new markets (i.e. invest in marketing and sales activity) – 47%

- Increase operational efficiency (cut costs, i.e. facilities, consumables, frills) – 26%

- Enlarge asset bases (invest in new equipment) – 16%

- Reduce labour cost (i.e. reducing hours or laying off staff) – 11%

The results of the LiveseySolar Summer 2016 Recession for Private Healthcare Companies poll are below

The best response to a recession for private healthcare companies is a combination of three moves

A study reported in the Harvard Business Review (HBR) broke down the combination of these responses and revealed which firms performed best. They studied 4,700 public companies, breaking down the data into three periods: the three years before a recession, the three years after, and the recession years themselves. They found that a specific combination of offensive and defensive strategy resulted in a near doubling of results against rivals.

Two offensive strategies to beat a recession

The two offensive strategies are:

- Develop new markets (i.e. invest in marketing and sales activity)

- Enlarge asset bases (invest in new equipment)

One defensive strategy to outrun a recession

The one defensive strategy that will best complement the two above is:

- Increase operational efficiency (cut costs, i.e. facilities, consumables, frills)

Interestingly, the results of our poll had most respondents (72%) choosing the two offensive strategies, but less than 10% choosing the optimal combination of offence and defence suggested by the HBR study.

Summary table of the Harvard Business Review’s research into the best combination of strategic business moves in a recession

HBR called the combination resulting in the best top- and bottom-line results a ‘Progressive Focus’. Firms taking this approach outperformed their rivals on both top- and bottom-line growth.

HBR explains that “After a recession, progressive companies outperform pragmatic companies by almost four percentage points in sales and more than three percentage points in earnings before interest, taxes, depreciation, and amortization (EBITDA)—and do about twice as well as companies in general. (Percentages, which are adjusted for industry averages, refer to the three-year compound annual growth rate.)”

The four different approaches companies can take during a recession will yield very different results

- Prevention-focused companies, which make primarily defensive moves and are more concerned than their rivals with avoiding losses and minimizing downside risks.

- Promotion-focused companies, which invest more in offensive moves that provide upside benefits than their peers do.

- Pragmatic companies, which combine defensive and offensive moves.

- Progressive companies, which deploy the optimal combination of defence and offence.

The article goes into greater depth and shares several examples of companies that followed the four different approaches cited above.

In summary, when facing the next recession, you’d be wise to be ‘Progressive’ by pursuing a combined strategy of marketing more, expanding your asset base, and increasing efficiency. The last thing you want to do is cut labour costs.

As it happens in this case, what’s good for business is also good for the economy as a whole.